Table of Contents

Key Points

-

The S&P 500 has been a wealth-building machine for long-term investors.

-

Its largest components are all AI stocks, giving investors exposure to AI tailwinds while minimizing risk.

-

The nature of the market is to have dips and corrections as it rises.

- 10 stocks we like better than Vanguard S&P 500 ETF ›

The S&P 500 is back to its glorious self this year, overcoming some challenges a few months ago to rise 14% year to date. It’s resilient, like the U.S. economy, driven by the largest of its 500 components.

There are a number of ways to invest in the S&P 500, and one of the most popular methods today is investing in an exchange-traded fund (ETF) that tracks it. The largest one is the Vanguard S&P 500 ETF (NYSEMKT: VOO), which has $1.4 trillion in assets, but there are several others.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

You might think it's a great time to buy in as the market rises, but it's not that simple.

Image source: Getty Images.

The best time

The S&P 500 has been a wealth-building machine for decades. It gains on average more than 10% annually; Compounded over time, especially with consistent additions, that turns into a lot of money for investors.

As the market rises, investors can benefit from increasing stock prices. And when you invest in an ETF that tracks the S&P 500, it takes all of the guesswork out of investing.

It also gives you exposure to the best companies on the market today, and since it's a weighted index, it's heavily skewed toward artificial intelligence (AI). The largest companies in the U.S. by market cap are the largest companies in the index, and today, these are all AI companies. The Vanguard ETF's top holdings are Nvidia, Microsoft, Apple, and Amazon, and they collectively account for 25% of the total portfolio.

These stocks have incredible long-term tailwinds. Investing in an S&P 500 ETF gives you access to these opportunities while minimizing the risk of investing in only one company.

The worst time

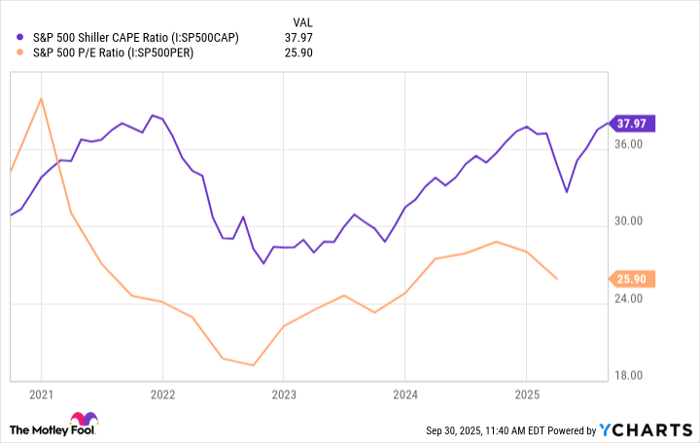

That being said, the best time to buy is on the dip, not at the top. The S&P 500 is breaking records all the time these days, and it's near its most expensive valuation. The average S&P price-to-earnings (P/E) ratio is almost 38, a five-year high. The cyclically adjusted P/E ratio, or CAPE ratio, which adjusts for inflation, is also near highs — outside of a spike in 2021 right before the market crashed.

S&P 500 Shiller CAPE Ratio data by YCharts.

What does that mean for investors? Nothing concrete, but the nature of the market is that there are always going to be dips, corrections, and even crashes on the way to the top. The market has always recovered and gone on to bigger and better, but as the S&P 500 becomes more and more expensive, the potential for some kind of correction looks likely.

The verdict

No one knows when there might be a dip, or worse. You can't time the market, and even though it's heading higher today, it could keep that up for a long time. It would be a shame to miss out on the growth because of fear of a correction. Keep in mind the potential for some near-term rebalancing as the market becomes even more expensive.

I would caution anyone who might need their funds in the near future to invest in safe, perhaps dividend-yielding stocks and keep some distance from anything that looks overpriced, including an S&P 500 ETF. But if you’re in it for the long term, and you have the ability to weather downturns, it’s always a good time to invest in the market, and an S&P 500 ETF is an excellent way to do that.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $621,976!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,150,085!*

Now, it’s worth noting Stock Advisor’s total average return is 1,058% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of September 29, 2025

Jennifer Saibil has positions in Apple. The Motley Fool has positions in and recommends Amazon, Apple, Microsoft, Nvidia, and Vanguard S&P 500 ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.